Thoughts from May 2015…

I write this as I prepare to graduate in less than two months from an online university with my Masters in Business Administration (MBA). In total it will have been a two year journey. I was fortunate to have received a full scholarship for my degree program based on an essay competition. It was a true blessing, because I had been looking at various graduate school options to pursue my MBA and was finding that pretty much all of them would be very expensive. I knew I had a passion for business and studying it at the graduate level seemed like the right idea.

Academics are great because they give you the opportunity to explore subject matter you might not have otherwise considered. The reality for me though is that I consume roughly one to two business related books a month through my membership at Audible.com and I have found that those have been the best educational resources I have been exposed to. My MBA has been more a supplement to my personal book consumption than the other way around. While a great experience, I don’t know that it would have been worth the roughly $25,000 that some people pay for their graduate studies at my university.

I think we need to look at return on investment and our personal cash flow when we consider whether graduate school is right for us. For some, their cash flow is either small or non-existent when they make the decision to go to graduate school. I recently met a girl at a party who studied a social science during her undergraduate time who was having a hard time finding a job. The field she was in didn’t require a Master’s for any kind of professional licensing, but she felt that a Master’s degree would make, “people take me more seriously.”

The young lady in question was already swimming in student debt, so I asked her, “Is there anything you can’t do now because you don’t have a Master’s degree?” Her response was, “No.” Despite this, I understood her rationale because so many other people have this same thought process. I have a Bachelor’s degree, but I can’t find a job. If I get my Master’s then all those closed doors should open up for me. Unfortunately, this is not likely the case for most. Unless you’re pursuing a graduate degree because it’s part of a professional licensing process (i.e. lawyer, doctor, psychologist, etc.), another degree is not a ticket to financial security. If anything, it’s doubling down on your personal debt.

According to the Federal Reserve Bank of New York, outstanding student loan debt in the United States lies between $902 Billion and $1 Trillion. As of Quarter 1 in 2012, the average student loan balance for all age groups is $24,301. Needless to say, at the time of this writing in 2015, these numbers have likely grown. Why is this a problem? One reason is that rising educational costs have saddled a new generation with levels of debt at the beginning of their career that they might not be able to pay off. A continued weak job market among young people compounds this issue.

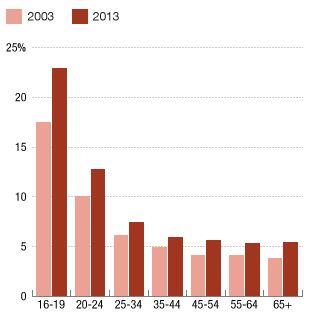

Unemployment by Age Group in the United States

Source: Bureau of Labor Statistics

Unemployment rates among younger Americans has grown significantly from levels just over a decade ago, despite rising levels of educational achievement in terms of degrees held. The increased pressure on entry level positions due to downsizing, technology replacing workers, and competition with older workers is only likely to exacerbate this situation. In this climate, many are easily sold on the idea that going back to school is their best option. To some extent, getting a Master’s degree does improve earnings and unemployment rates on average.

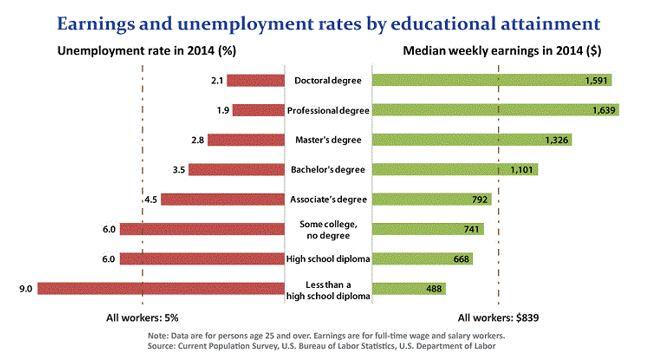

Source: Bureau of Labor Statistics, 2015

The reality is that even with average numbers, the difference between an undergraduate degree and a non-professional Master’s degree is pretty small; particularly in the area of unemployment likelihood. It’s worth noting that most Bachelor degree holders looking for a job would likely disagree with the official government numbers saying that only 3.5% of them are looking for jobs. Uncle Sam counts part-time jobs like bar tending or a barista job as part of the employment numbers, so the true statistics aren’t really reflected by the pretty charts produced by our federal Labor Department.

Based on the official numbers taken at face value, graduate school seems like a good deal. The problem with financed education is that student loan debt is one of the few types of debt that is not dischargeable in bankruptcy court. In other words, like herpes, it’s with you forever. If you have $25,000 of unsubsidized debt at 4.00% from undergraduate studies then your payment when you graduate (due six months after graduation) is roughly $250 a month. You will pay roughly $5,374 in interest on your debt over the 10 year standard period. As you might have figured out, graduate school at an additional $25,000 would double this number. There is also no guarantee you will have a job at the end or that your income will support that increased student debt payment.

The truth is that you might be graduating with far more debt than the example we laid out here supposes, therefore you need to run personal numbers for yourself: https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action

Unless your chosen profession requires a graduate degree for licensing, give serious thought to your decision on pursuing another degree through student loan financing. Aside from hurting your monthly cash flow situation upon graduation, you could be setting yourself up for a financial calamity you won’t be able to resolve in a bankruptcy court. While credit cards, mortgages, and car loans can all be absolved in a bankruptcy, your student loans cannot. Before you enroll, decide what your return on investment will be. How much more do you expect to make based on your financial investment in higher education? Does it fit within your cash flow requirements upon graduation? These simple questions could keep you from making an irreversible financial mistake that will follow you for many years.

This is so true. I have a GED and no student loans, while many of my co-workers have student loan debit. Yet we all make about the same salary.

This seems to be happening more and more as advanced degrees become more commonplace, but workplace experience shrinks with Baby Boomer’s leaving the workforce. Experience and know-how often trumps degrees when professional licensing isn’t a requirement.

Consider as well tuition reimbursement options from your employer (or even your parents employer) and if grad school is an absolute must for you, then why not explore options where some other entity is paying for this? Many companies offer tuition reimbursement and with the amount of reputable brick and mortar universities offering entirely online degree programs , it is certainly worth exploring. This may mean it will take a little longer to complete, but there are no loans at the end!

Great point Alex!