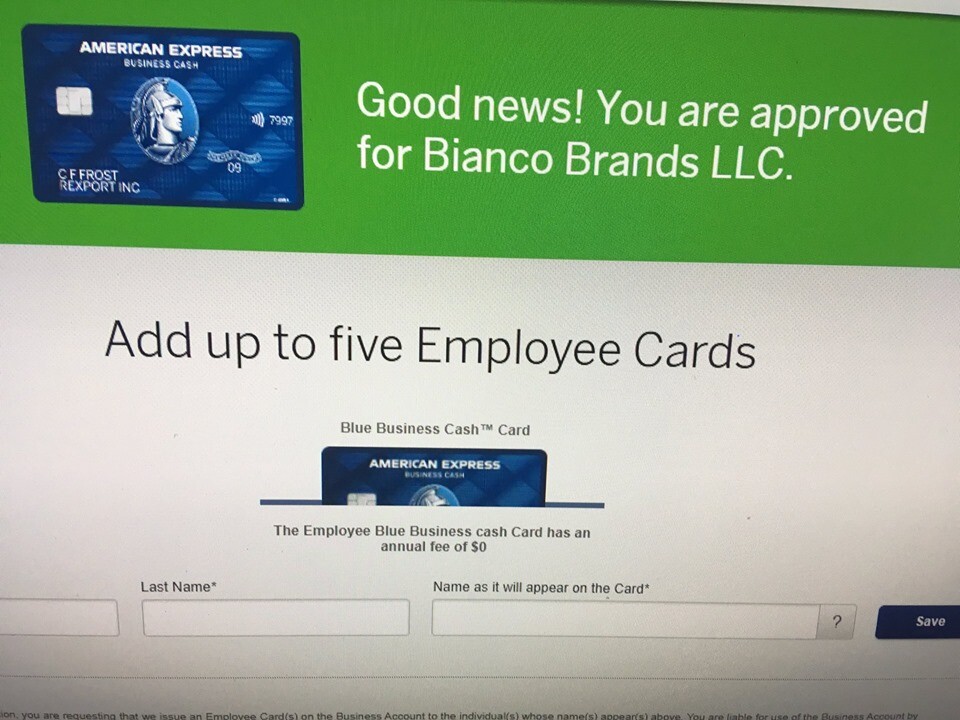

After dragging my feet for about a year, I finally applied and was approved for a company AMEX business card for my t-shirt business. I looked at a TON of other business credit cards before I chose the American Express Blue Business Cash Card. In this article, I’m going to explain why I chose the AMEX blue biz card over all others.

First, if you’ve been intimidated about opening your first business credit card, don’t be. It took two minutes. I don’t know why I waited this long to do it.

Having a business credit card is essential to avoid comingling your non-business expenditures with your business expenses. I broke this rule for a long time because I wanted credit card perks for my business expenses. Little did I know, there are credit cards with perks for business, and they don’t all have some crazy annual fee associated with them.

I’ll start by explaining why the AMEX small business offer appealed to me. My online business is still pretty new, and I’m not making massive revenue. I did not want a card that had a ton of expenses associated with it. Perhaps the most appealing thing about this card is that it has no annual fee EVER. I hate when cards pull the bait & switch with only waiving fees the first year.

The second appealing aspect of this card is that it has the highest cashback of pretty much all the business credit cards I researched. The American Express Blue Business Cash Card weighs in at a beefy 2% cash back rate.

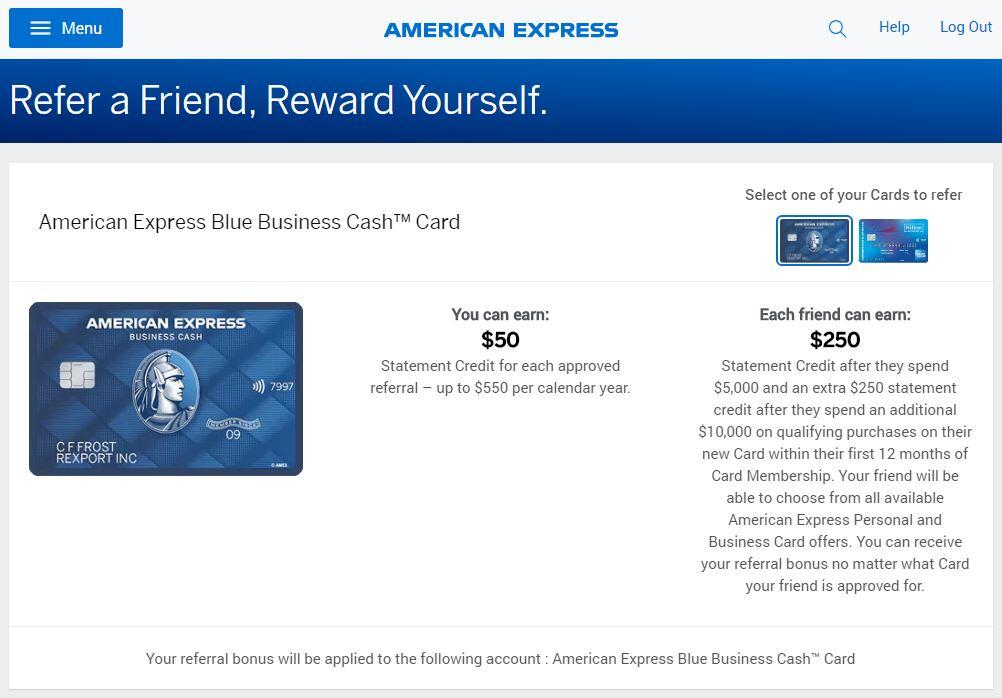

The third cool thing about this is that it has a great referral program. Needless to say, if you’d like to use my referral link, I’d very much appreciate it! If you do use my link, American Express is going to give you $250 when you spend your first $5,000 on the card and then another additional $250 after you spend $10,000.

What sucked for me was that I was not referred by someone and missed out on that bonus 😢

For people you refer to the program, you’ll earn $50 with a cap of $550 a calendar year. I’m sure everyone knows or will know some fellow entrepreneurs they can refer to the program.

I’ve told you why I like the American Express blue card and why I picked it, so why don’t I go on a rant now about what I didn’t like about the other cards. These will be in no particular order.

The Ink Business Unlimited Credit Card was the first option I considered. It also has no annual fee and even offers a $500 bonus. However, this card only has 1.5% cashback, and I don’t like the idea of trading a half percentage point for a one-time cash bonus. In just a couple of years of regular spending, this would be a losing deal from the lost cashback percentage.

There is another thing about Chase cards I don’t like called the “5/24 Rule”. This rule is a well-known policy in the travel hacking community that limits the amount of credit lines you get with the company in a certain amount of time. If you already have several lines of credit with Chase or you anticipate taking advantage of one of their personal credit offers then you may be better off with using a different company for your business credit line. Using a different company will also help with not accidentally confusing your personal card and business card.

The Capital One Spark cashback card is another one I came across. This one also boasts a 2% cashback rate, as well as a bonus; however, it has an annual fee. After the first year, you’ll be paying Capital One for the privilege of giving you something American Express will provide you with no annual fee. No thanks, Capital One.

One thing I’ll mention about the bonuses as well; these come with a time restriction. In the case of the Capital One Spark card, you have to spend $4500 in the first three months, or you will miss the bonus.

The Ink Busines Cash credit card looked pretty good with no annual fee and a bonus until I realized that they have a variable cashback rate. While specific limited categories will get you the occasional 2 or 5 percent cashback rate, most of your purchases are going to be at a 1% rate.

The Discover It Business card has no annual fee, but it is only 1.5%, and some of the vendors I use don’t accept Discover cards. Specifically, when I checked, it didn’t seem like Amazon Advertising took it, which is a big chunk of my business spending.

The Ink Business Preferred credit card has a $95 annual fee right off the bat and it does points instead of cashback. Given that these companies can, and frequently do, change the terms on the value of their point redemption, I wouldn’t go with this.

The Capital One Spark Cash Select for Business card has no annual fee, but like the other card we discussed it’s rewards rate is only 1.5%. The bonus on this one is also lower than other offerings at $200.

The Capital One Spark Miles for Business card is another one with an annual fee and a rewards point setup. Even with the intro bonus on points initially, over time, the miles are not likely to be as valuable as cashback.

The last cashback one I looked at was the Bank of America Business Advantage Cash Rewards Mastercard. With no annual fee and intro bonus, I thought it sounded pretty good. Then I realized that this one too does the variable cashback depending on category. Like the Ink Business card, you’re mostly going to be getting 1% cashback on most things.

I won’t go into as much depth on the travel rewards business credit cards, because the fees on these are plain absurd. I don’t know why anyone would pay this much (or anything really) for a credit card. Unless you are living in the airport like Tom Hanks in the movie Terminal, then you’re better off with a cash back option.

Without going into a list of all of them, let me share some of the particularly notable INSANE annual fees on these:

- American Express Business Platinum Card ($595 annually)

- Southwest Rapid Rewards Performance Business Credit Card ($199 annually)

- Marriott Bonvoy Business American Express Card ($125 annually)

- Platinum Delta SkyMiles Business Credit Card ($195 annually)

- American Express Business Gold Card ($295 annually)

Given those crazy high fees, I’m pleased with my choice of the American Express Blue Business Cash card.

For travel perks, I rather have those as my personal credit cards where the fees are lower or non-existent entirely.

I hope this article helped you in choosing the right small business credit card for your circumstances. Don’t wait as long I did to knock out this necessary business management task. Providing that you are creditworthy, you’ll have no problem getting the AMEX blue business card. Being a new business without a corporate credit history does not impact this. The company will use your personal credit score and history to consider your application for a business credit card.

Disclosure: Bear in mind the links in this post are referral links and if you go through them I will earn a referral bonus. Keep in mind that I link these companies and their products because of their quality and not because of the referral incentive I receive from your interest. The decision is yours, and whether or not you decide to use something I recommend is completely up to you.

Leave a Reply