My financial understanding changed greatly with a simple question from my JPCashFlow.com co-contributor in roughly January 2013. “Ever hear of Robert Kiyosaki?” he asked. I had not, but that question would launch me on a path to achieving financial literacy with an almost obsessive fervor. Over the next year or so, not only would I read “Rich Dad, Poor Dad”, but also most of the books in the Rich Dad collection as well. As of this writing, I’ve consumed 13 of the Rich Dad series books. Kiyosaki and his Rich Dad brand can be summarized into a few key points.

- You will not get rich from a paycheck

This might be one of the hardest things to understand. When we think of the rich, we might often think of high-income earners like doctors and lawyers. Kiyosaki argues that wealth isn’t built by paychecks, but instead by investments and business. In his book “Cash Flow Quadrant”, Kiyosaki explains that there are essentially four categories of income generation: Employment, Self-Employment, Business, and Investment. People on the left side of the quadrant trade their hours for dollars. People on the right side of the quadrant do not. An unfortunate irony for most employees and self-employed people is that they will often pay higher taxes given the category they make most, if not all their money in.

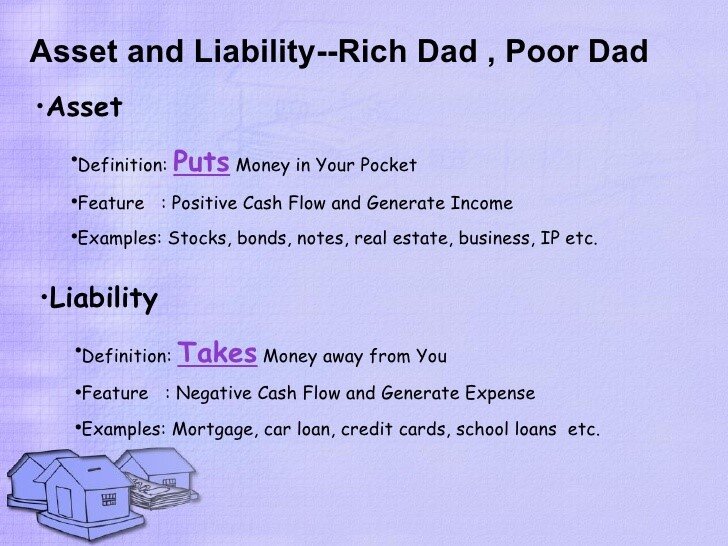

- Your house is a liability, not an asset

Kiyosaki has received a great deal of negative press attention for this sentiment. Americans have a strong feeling about their house and the pride that comes with home ownership. The housing market crash of 2008 gave some greater legitimacy to Kiyosaki’s argument and understanding of his point. Kiyosaki’s definitions of an asset and liability differ quite a bit from the traditional accounting definition of those terms. In his opinion, an asset is something that generates income and a liability is something that costs money. His purpose in saying, “Your house is not an asset” is to demonstrate to people that while they might be building equity; their mortgage is still a giant liability that relies on positive cash flow to stay afloat. He doesn’t discourage home ownership, but he does want people to understand the difference between cash flow positive and negative. This leads us to our third and final point…

- Cash Flow is King

Kiyosaki often asks his readers how long they would survive without a paycheck. That time frame is the freedom equation. I’ve asked myself how many days I could go without a paycheck while still paying my bills and buying groceries. I didn’t like the answer at the time and have spent significant effort on increasing that notional number of days. There are two things that can be learned from this principle. The first is that an emergency fund is critical to economic survival. After being furloughed at my job twice in the course of a year, I finally understood that. In the movie, “Spy Game” Robert Redford’s character poses the question, “When did Noah build the ark?” He answers his own question, quipping “Before the storm.” Economically we should all be following that advice. Personal Finance guru Suze Orman often suggests an emergency fund account that equals six months of your take home pay.

The second part of this equation is realizing that cash flow from business and investment should be a top priority for everyone. There is nothing wrong with being an employee and most people are, but how are you diversifying your risk and income streams? There are countless ways of doing this. For me, the answer was selling things on Amazon and learning how to invest in a variety of asset classes outside of my normal 401K. For Peter, he has woodworking skills that he can profit from and also enjoys stock options trading. Your skills, interests, and capabilities might be different from ours, so find a solution that works for your personal situation.

In conclusion, here are some action steps to get you started. Commit to a timeframe in which you will start these, set a target date for when you plan to complete them, and write down your conclusions:

- Determine how long you could last without a paycheck and how much should be in your emergency fund

- Take a personal inventory of what your assets are (things that provide you income) and what your liabilities are (what takes money away from you). What liabilities would you be willing to sacrifice to increase your positive cash flow? What kind of assets do you want to own?

- What skills, interests, and capabilities do you have that you can turn into extra income?

- Increase your financial education daily. Commit to reading or listening to financial education material every day for at least 30 minutes. Podcasts and audiobook can help you incorporate this into other daily routines like your commute or working out.

If you enjoyed this article, please use the buttons below to share with your friends. If you would like more content from JPCashFlow.com, be sure to subscribe to our email list and follow us on social media. Thanks for your readership!

I think this is wonderful, alot of great information. I feel I will learn alot from the information you are offering. I will share this website with all my friends and family.